- Corporate Tax

- VAT Registration & Filling

- Certificate Attestation

- Company Liquidation

In January 2022, The Ministry of Finance announced that the UAE government will be implementing Federal Corporate Tax (CT) on the net profit of businesses. The Corporate Tax in UAE came effective from the 1st of June 2023. Corporate Tax or Corporate Income Tax or Business Profits Tax will be applicable on or after the 1st of June 2023 depending on the financial year followed by the businesses, and from there on, all over the country, every business apart from the exempted group will be subjected to CT. Corporate tax is a type of direct tax imposed on net income. At present, the UAE has recorded the lowest tax rate of 9%compared to other GCC countries. On recalling the G7 countries’ meeting in 2021, the Gulf countries entered into an agreement where a global minimum corporate tax return of 15% was introduced. The United Arab Emirates chose 9% over 15% to reduce its direct impact on entrepreneurs. Business entities are the ones subjected to this direct tax, while individuals’ earning income in their personal capacity, which does not require a commercial license, is not taxable.

In January 2022, The Ministry of Finance announced that the UAE government will be implementing Federal Corporate Tax (CT) on the net profit of businesses. The Corporate Tax in UAE came effective from the 1st of June 2023. Corporate Tax or Corporate Income Tax or Business Profits Tax will be applicable on or after the 1st of June 2023 depending on the financial year followed by the businesses, and from there on, all over the country, every business apart from the exempted group will be subjected to CT. Corporate tax is a type of direct tax imposed on net income. At present, the UAE has recorded the lowest tax rate of 9%compared to other GCC countries. On recalling the G7 countries’ meeting in 2021, the Gulf countries entered into an agreement where a global minimum corporate tax return of 15% was introduced. The United Arab Emirates chose 9% over 15% to reduce its direct impact on entrepreneurs. Business entities are the ones subjected to this direct tax, while individuals’ earning income in their personal capacity, which does not require a commercial license, is not taxable.

Corporate Tax is a form of direct tax levied on the net income of corporations and other businesses. Corporate Tax is sometimes also referred to as “Corporate Income Tax” or “Business Profits Tax” in other jurisdictions.

Broadly, Corporate Tax applies to the following “Taxable Persons”:

- UAE companies and other juridical persons that are incorporated or effectively managed and controlled in the UAE;

- Natural persons (individuals) who conduct a Business or Business Activity in the UAE as specified in a Cabinet Decision to be issued in due course; and

- Non-resident juridical persons (foreign legal entities) that have a Permanent Establishment in the UAE (which is explained under [Section 8]).

Juridical persons established in a UAE Free Zone are also within the scope of Corporate Tax as “Taxable Persons” and will need to comply with the requirements set out in the Corporate Tax Law. However, a Free Zone Person that meets the conditions to be considered a Qualifying Free Zone Person can benefit from a Corporate Tax rate of 0% on their Qualifying Income (the conditions are included in [Section 14]).

Non-resident persons that do not have a Permanent Establishment in the UAE or that earn UAE sourced income that is not related to their Permanent Establishment may be subject to Withholding Tax (at the rate of 0%). Withholding tax is a form of Corporate Tax collected at source by the payer on behalf of the recipient of the income. Withholding taxes exist in many tax systems and typically apply to the cross-border payment of dividends, interest, royalties and other types of income.

Certain types of businesses or organisations are exempt from Corporate Tax given their importance and contribution to the social fabric and economy of the UAE. These are known as Exempt Persons and include:

Automatically exempt | ● Government Entities ● Government Controlled Entities that are specified in a Cabinet Decision |

Exempt if notified to the Ministry of Finance (and subject to meeting certain conditions) | ● Extractive Businesses ● Non-Extractive Natural Resource Businesses |

Exempt if listed in a Cabinet Decision | ● Qualifying Public Benefit Entities |

Exempt if applied to and approved by the Federal Tax Authority (and subject to meeting certain conditions) | ● Public or private pension and social security funds ● Qualifying Investment Funds ● Wholly-owned and controlled UAE subsidiaries of a Government Entity, a Government Controlled Entity, a Qualifying Investment Fund, or a public or private pension or social security fund |

In addition to not being subject to Corporate Tax, Government Entities, Government Controlled Entities that are specified in a Cabinet Decision, Extractive Businesses and Non-Extractive Natural Resource Businesses may also be exempted from any registration, filing and other compliance obligations imposed by the Corporate Tax Law, unless they engage in an activity which is within the charge of Corporate Tax.

Corporate Tax is imposed on Taxable Income earned by a Taxable Person in a Tax Period.

Corporate Tax would generally be imposed annually, with the Corporate Tax liability calculated by the Taxable Person on a self-assessment basis. This means that the calculation and payment of Corporate Tax is done through the filing of a Corporate Tax Return with the Federal Tax Authority by the Taxable Person.

The starting point for calculating Taxable Income is the Taxable Person’s accounting income (i.e. net profit or loss before tax) as per their financial statements. The Taxable Person will then need to make certain adjustments to determine their Taxable Income for the relevant Tax Period. For example, adjustments to accounting income may need to be made for income that is exempt from Corporate Tax and for expenditure that is wholly or partially non-deductible for Corporate Tax purposes.

The Corporate Tax Law also exempts certain types of income from Corporate Tax. This means that a Taxable Persons will not be subject to Corporate Tax on such income and cannot claim a deduction for any related expenditure. Taxable Persons who earn exempt income will remain subject to Corporate Tax on their Taxable Income.

The main purpose of certain income being exempt from Corporate Tax is to prevent double taxation on certain types of income. Specifically, dividends and capital gains earned from domestic and foreign shareholdings will generally be exempt from Corporate Tax. Furthermore, a Resident Person can elect, subject to certain conditions, to not take into account income from a foreign Permanent Establishment for UAE Corporate Tax purposes.

Corporate Tax will be levied at a headline rate of 9% on Taxable Income exceeding AED 375,000. Taxable Income below this threshold will be subject to a 0% rate of Corporate Tax.

Corporate Tax will be charged on Taxable Income as follows:

Resident Taxable Persons | |

Taxable Income not exceeding AED 375,000 (this amount is to be confirmed in a Cabinet Decision) | 0% |

Taxable Income exceeding AED 375,000 | 9% |

Qualifying Free Zone Persons | |

Qualifying Income | 0% |

Taxable Income that does not meet the Qualifying Income definition | 9% |

Registering, Filing And Paying Corporate Tax

All Taxable Persons (including Free Zone Persons) will be required to register for Corporate Tax and obtain a Corporate Tax Registration Number. The Federal Tax Authority may also request certain Exempt Persons to register for Corporate Tax.

Taxable Persons are required to file a Corporate Tax return for each Tax Period within 9 months from the end of the relevant period. The same deadline would generally apply for the payment of any Corporate Tax due in respect of the Tax Period for which a return is filed.

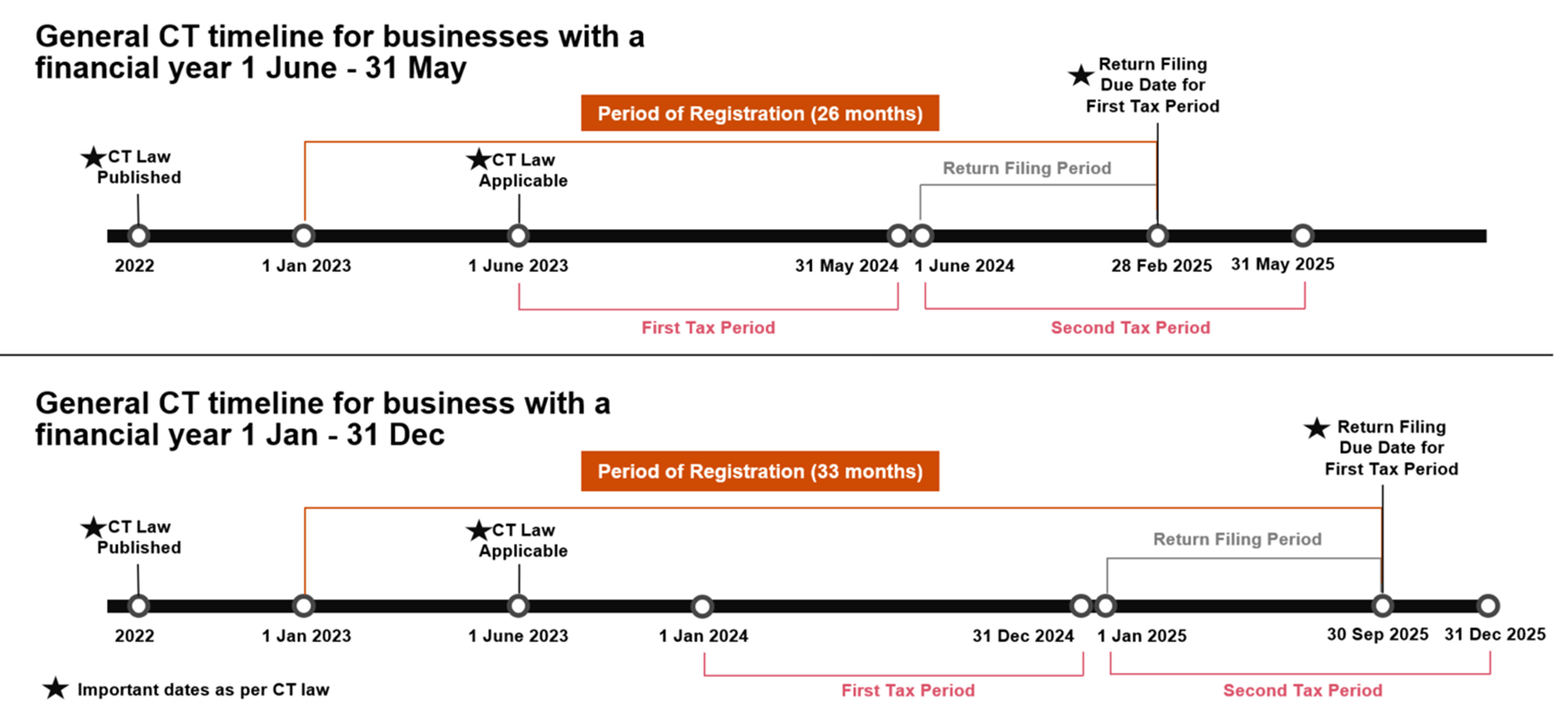

Illustrated below are examples of the registration, filing and payment deadlines associated for Taxable Persons with a Tax Period (Financial Year) ending on 31 May or 31 December (respectively).

Required Documents And Forms

In case of applicant is a Natural Person

● Trade license, where applicable

● Emirates ID / Passport of the applicant

In case of application is a Legal Persons

● Trade license

● Emirates ID / Passport of authorized signatory

● Proof of authorization for the authorized signatory.

Estimated Time To Complete Application By The FTA

20 business days from the date the completed application was received by the FTA. However, in case where any additional information is needed, FTA may take additional time to process the application. The applicant needs to provide the additional information and re-submit the application. It may take the FTA a further 20 business days to respond to the updated application. If the application is not resubmitted within 60 calendar days from the date you received the notification from FTA, the application shall be rejected. OJO team understand every SME or corporates has its own unique needs. Hence we offer customized services that focus on those needs, ensuring you navigate VAT requirements easily. Whether you’re seeking VAT Services in Dubai, Abu Dhabi, or across the UAE, we will work closely with you and provide guidance through the VAT registration and submission process, making sure everything remains compliant with local regulations.

OJO team understand every SME or corporates has its own unique needs. Hence we offer customized services that focus on those needs, ensuring you navigate VAT requirements easily. Whether you’re seeking VAT Services in Dubai, Abu Dhabi, or across the UAE, we will work closely with you and provide guidance through the VAT registration and submission process, making sure everything remains compliant with local regulations.

UAE VAT Registration

If you are a business owner in UAE you need to get your business registered under the VAT law that has come on effect from 1st January 2018. Once a company is registered for VAT in Dubai, it must file VAT returns on a regular basis or as set by the authority.

VAT Registration is mandatory for companies and individuals doing businesses in the UAE if the annual turnover is more than AED 375,000/-

The VAT registration processes in Dubai involve:

- Register for VAT

- Charge VAT on the invoices issued to the clienteles

- Announce the VAT to the Federal tax authorities through a VAT filing

The Importance Of VAT Registration

Experts observe that the introduction of VAT in UAE will bring long-term benefits to the country’s economy and business owners. The significant reasons why VAT registration in Dubai is considered important include:

- It enhances the business profile

- It avoids unnecessary penalties

- It allows claiming VAT refunds

- It widens the market possibilities

Documents Required For VAT Registration In Dubai

- Passport copy or Emirates ID to prove the identity of the authorized party

- Trade license copy of the company

- Certificate of Incorporation of the company

- Certificate of Articles of Association of the company

- Certificate of Power of Attorney of the company

- Description of business activities

- Turnover for the last 12 months in AED

- Supporting document for 12-month sales

- Expected turnover in the next 30 days

- Estimated value of imports for one year from all GCC countries

- Estimated value of exports for one year to all GCC countries

- Your consent whether you deal with GCC suppliers or customers

- Supporting documents for customs registration in the Emirates if applicable.

- Details of Bank Account

VAT REGISTRATION PROCESSES

Basically, a business can opt for any of the two types of VAT registration in UAE:

1. Mandatory Registration

It is mandatory that a business must register for VAT:

- If the total value of its taxable supplies and imports exceeds the required registration threshold over the previous 12 months

- If the business expects that the total value of its taxable supplies and imports will exceed the obligatory registration threshold in the next 30 days.

The threshold for mandatory registration of a business is AED 375,000. But this threshold is not applicable to foreign organizations.

2. Voluntary Registration

A company may opt for Voluntary Registration:

- If it does not meet the mandatory registration criteria,

- If the total value of its taxable supplies and imports or taxable expenses in the preceding 12 months surpasses the voluntary registration threshold,

- If the business foresees that the total value of its taxable supplies and imports or taxable expenses will exceed the voluntary registration threshold in the next 30 days.

The threshold for voluntary registration of a company is AED 187,500.

VAT FLOW CHART

Assessment & Consultation -

Review of business model, revenue, and transactions to determine VAT obligations and eligibility.

1VAT Registration -

Complete and submit the VAT registration form on your behalf, ensuring all necessary documentation and information are accurately provided.

2Record Keeping -

Maintain records of all taxable transactions to ensure compliance with VAT regulations.

3Ongoing Compliance & Advisory

Provide ongoing support to make sure you remain compliant with VAT laws, including updates on any changes in regulations.6Audit & Reporting Support -

Assist you in case of any tax audits or inquiries from the tax authority and provide the necessary reports for management review.7 OJO team provides attestation services for all kinds of documents. The purpose of this procedure is to check the validity of stamp and signature on such documents, whether issued inside or outside Country. This covers attestation services provided in UAE as well as UAE missions abroad to include the legalization process of ordinary certificates issued inside and outside UAE. This encompasses educational and medical certificates, marriage and divorces contracts, powers of attorney, etc., in addition to the attestation service of commercial contracts and agreements.

OJO team provides attestation services for all kinds of documents. The purpose of this procedure is to check the validity of stamp and signature on such documents, whether issued inside or outside Country. This covers attestation services provided in UAE as well as UAE missions abroad to include the legalization process of ordinary certificates issued inside and outside UAE. This encompasses educational and medical certificates, marriage and divorces contracts, powers of attorney, etc., in addition to the attestation service of commercial contracts and agreements.

Company liquidation is a long and tedious process. It might be compulsory or voluntary. Once you plan to close down your business the government entities should be notified of the same so as to avoid any accumulated fines and penalties. License cancellation is one of the primary steps in the liquidation process and the formalities differ based on the form of company and the jurisdiction where the company is registered.

Company liquidation is a long and tedious process. It might be compulsory or voluntary. Once you plan to close down your business the government entities should be notified of the same so as to avoid any accumulated fines and penalties. License cancellation is one of the primary steps in the liquidation process and the formalities differ based on the form of company and the jurisdiction where the company is registered.

Various clearances are to be acquired from various departments such as:

- Ministry of Human Resources and Emiratisation

- Directorate of Residency and Foreigners Affairs

- The relevant Water and Electricity Authority

- The leasing entity

- FTA

Our liquidation experts provide clients with a straight-forward and cost-effective process that brings the company to an orderly end while providing formal closure and certainty to the affairs of the company. Services include from preparation of liquidation plan to appropriate documentation for company strike-off. Our deep understanding of local requirements helps us adapt and implement global best practices locally, ensuring excellent standards in all our services.